Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #66 – Healthtech with Richard Chu

We all want to live longer and healthier lives, so it’s no surprise that healthcare technology is a major area of research and innovation. Medtech and biotech are key investment themes in the Telescope Investing model portfolio, and in our own personal portfolios.

This week we had the pleasure of connecting with healthtech expert investor Richard Chu. Richard shares his thoughts on the healthtech sector, his key investments in this area including GoodRx, Doximity, and OptimizeRx, and also how he saw the writing on the wall for Teladoc Health and exited early, avoiding the share price slump that has hurt our own returns this year!

Podcast #43 – Dear diary

Just over a year ago, when the coronavirus pandemic was beginning, we both started investing journals, to capture our thoughts about life, and the investment opportunities presented by the rapidly changing environment.

In this week’s pod, we revisit some of our journal entries from that period of wild volatility and uncertainty. We saw early signs of the types of businesses that would benefit from stay-at-home orders, and we make some predictions and some investments based on our forecasts of how the business landscape would be impacted. It’s now one year later, so how did we do?

Podcast #31 – Teladoc Health deep dive

This week, Albert & Luke do a deep-dive into another stock in the model portfolio for 2021, Teladoc Health, a leader in telehealth and digital therapeutics. Teladoc’s mission is to create a virtual healthcare system to improve care and cut the cost of healthcare for all. They have grown revenues rapidly over the last three years, boosted in part by the global pandemic, but do they have what it takes to fend off the increasing competition chasing them from the rear?

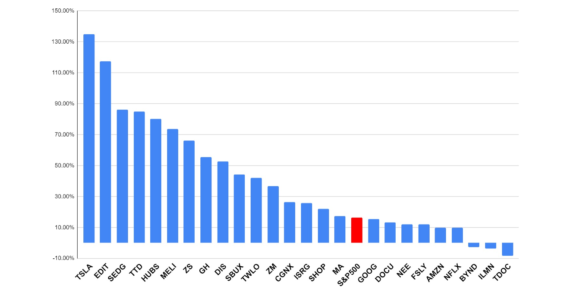

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January

Is the pandemic fever breaking?

As 2020 draws to a close and I consider what next year may hold, it thankfully seems likely that we’ll put the Coronaconomy behind us. A number of strong vaccine candidates are starting to roll-out, and although it’ll take at least a quarter or two, I’m optimistic that by mid-year normal service will largely be restored. In this article, I consider what this could means for my investment portfolio, and why it might be time to trim a few of my ‘work from home’ stocks

Is Zoom doomed and are they shutting up shop at Shopify?”

The Coronavirus pandemic has accelerated the take-up of e-commerce and remote working across a broad range of society, as many people have been forced to shop, and to work, online. Luke looks ahead to what a post-Covid world could look like for his Coronaconomy investments

Model portfolio first quarter review – beating the market by 17%

Luke undertakes a first quarter review of the Telescope model portfolio, created in July, and provides a few thoughts on how he might do things differently today

Podcast #8 – Investing in the trend of mobile working

Working from home has been one of the hallmarks of the Coronacomony, but the nature of work was already changing. In this week’s episode, Luke & Albert talk about the drivers and the impacts of an increasingly mobile workforce and share their stock tips for this megatrend.