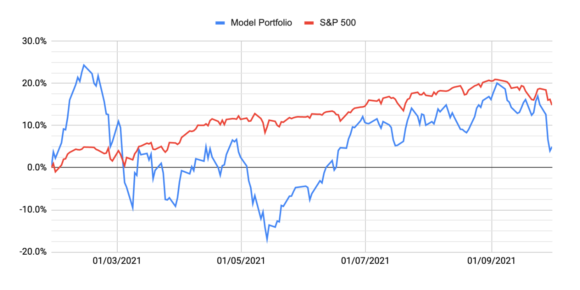

Podcast #59 – Model portfolio Q3 review

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

Is the pandemic fever breaking?

As 2020 draws to a close and I consider what next year may hold, it thankfully seems likely that we’ll put the Coronaconomy behind us. A number of strong vaccine candidates are starting to roll-out, and although it’ll take at least a quarter or two, I’m optimistic that by mid-year normal service will largely be restored. In this article, I consider what this could means for my investment portfolio, and why it might be time to trim a few of my ‘work from home’ stocks

Podcast #9 – Fiverr deep dive

Fiverr is an online marketplace connecting freelancers with clients, and its stock price has rocketed since the start of the coronavirus pandemic. In this week’s episode, Luke and Albert dive into Fiverr’s business to see if it is worth considering as a good long-term investment

Podcast #8 – Investing in the trend of mobile working

Working from home has been one of the hallmarks of the Coronacomony, but the nature of work was already changing. In this week’s episode, Luke & Albert talk about the drivers and the impacts of an increasingly mobile workforce and share their stock tips for this megatrend.

How to size a position

Luke shares his current portfolio, and talks about his personal approach to dollar cost averaging.