Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

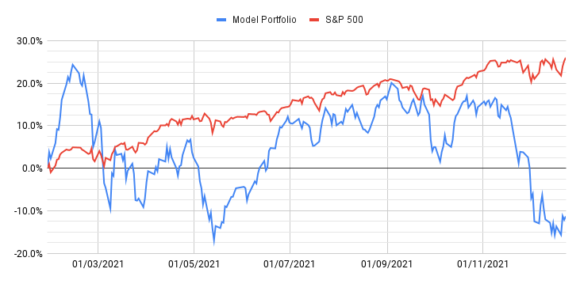

Podcast #71 – Model portfolio year-end review

The time has come for the year-end review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The chart above illustrates the torrid time the last quarter has been for growth stocks and our model portfolio. As growth investors, you get somewhat accustomed to volatility but this year has been especially turbulent as investor sentiment swung back and forth due to a series of world events. This was the year to be an index investor as the S&P steadily climbed and ended the year up almost 30%.

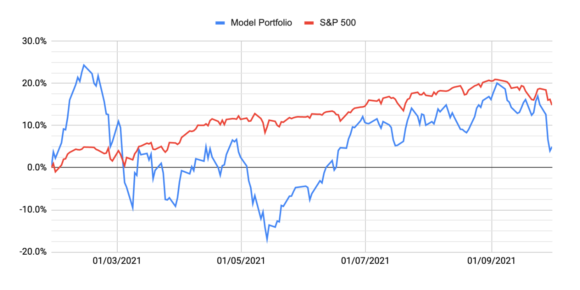

Podcast #59 – Model portfolio Q3 review

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

Podcast #53 – Cloud communications with Paul Ruppert

Cloud communications, also known as Communications Platform as a Service (or CPaaS) allows businesses to communicate with their customers using channels such as voice, email, SMS, and instant messaging.

This week we sit down with industry expert, Paul Ruppert, to discuss his insights on this complex market, and hear a few anecdotes from his 20-year career in C-level roles with leading global CPaaS providers including Syniverse, mBlox (Sinch), Infobip, SAP, and Route Mobile.

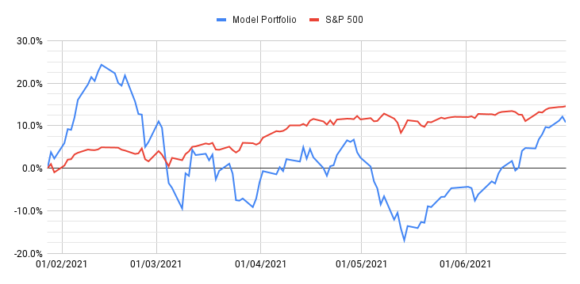

Podcast #46 – Model portfolio Q2 review

It’s time for the half-year review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The sell-off in growth stocks earlier this year made for grim reading at the end of Q1, but many of these stocks have rebounded – ten of the stocks in the model portfolio are now up from our start date, with nine of them beating the market (S&P 500).

Unfortunately, a couple of big losers are dragging down the overall return. While it’s probably too early to declare that “growth is back!”, our portfolio performance at the end of Q2 is much closer to the benchmark of the S&P 500 index. In this episode, we dig into some of the key stories and updates from the portfolio.

More stock therapy

On this week’s Pod Albert and I had a bit of a therapy session, sharing the woes of all growth investors, reflecting on some of the actions we’ve taken over the last few months to prepare ourselves for this eventuality, and also steeling ourselves for the volatility that is doubtless going to persist for many months (years?) yet.

Twilio one-pager

In Pod #36 we deep-dived Twilio, here’s a one-page summary of our research.

Podcast #36 – Twilio deep dive

Communication is a core function of almost every app, from ordering a pizza, hailing a ride, to booking a doctor’s appointment. This week, Luke & Albert deep dive into one of the leading providers of this core functionality, Twilio. Twilio is one of the stocks in the model portfolio for 2021 and we discuss why we think it is a strong company with room to grow. Also, Luke muses on his dreams of a space economy.

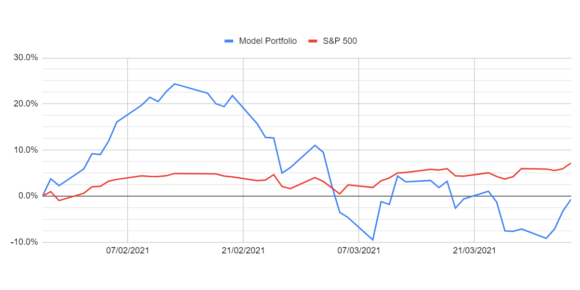

Podcast #33 – Model portfolio Q1 review

In this week’s episode, Luke & Albert check in with their model portfolio and see how the stock picks have performed in the first quarter, but more importantly, how the businesses have fared and whether or not the investment theses have changed.