Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

How I manage my own portfolio

Luke discusses how he uses the Telescope Investing approach to manage his own portfolio, and how this informed his recent purchase of Fastly, and a reduction in his Tesla position.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

Podcast #61 – Investing in disruptive innovation with Simon Erickson

This week we were delighted to connect with Simon Erickson, founder and CEO of 7investing.com, to chat about a topic that underpins both the 7investing and Telescope Investing strategy – investing in disruptive innovation.

Simon shares his thoughts on finding and evaluating disruptive companies, why larger companies find disruptive innovation difficult, playing offence and defence in your portfolio, plus we chat about hype vs fundamentals, craft beer, and being neighbours with Morgan Housel!

If you’re a growth investor, this episode is pure gold – highly recommended listening for all Telescope subscribers.

Podcast #56 – Into the mailbag

In this week’s pod, we dip into the mailbag to answer some listener questions on high valuation companies and diversification across asset classes. We also goggle at the madness of NFTs and talk about when it’s the right vs wrong time to sell. Transcript Albert: Hi, this is Albert. Luke:

Podcast #43 – Dear diary

Just over a year ago, when the coronavirus pandemic was beginning, we both started investing journals, to capture our thoughts about life, and the investment opportunities presented by the rapidly changing environment.

In this week’s pod, we revisit some of our journal entries from that period of wild volatility and uncertainty. We saw early signs of the types of businesses that would benefit from stay-at-home orders, and we make some predictions and some investments based on our forecasts of how the business landscape would be impacted. It’s now one year later, so how did we do?

Podcast #37 – Managing a portfolio

In this week’s pod, Luke and Albert answer some listener questions on portfolio management and talk about how they approach starting, adding, trimming and sometimes exiting a position

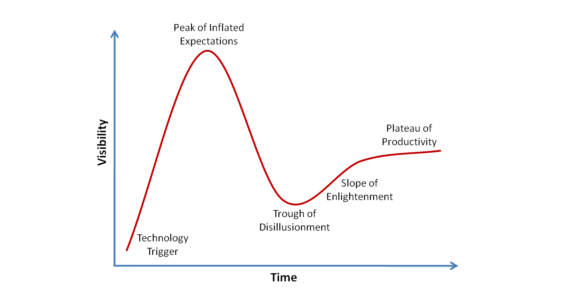

Podcast #34 – Hype cycles

It can be exciting to invest in new innovations and it’s easy to get carried away with the next big thing. In this week’s pod, Luke & Albert take a look at a few recent Gartner hype cycles and talk about some of the innovations that impact their own investments – past, present and future

Our investment plan for 2021

At Telescope Investing, we’re firm advocates of the long term buy and hold approach. We try our best to make sense of the world, and then to make forecasts about the needs and demands of the world a year or ten years from now, and then we try to find the companies that we think are best positioned right now to serve that need.

In this article, Luke describes how these principles were used to create the 2021 model portfolio