Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

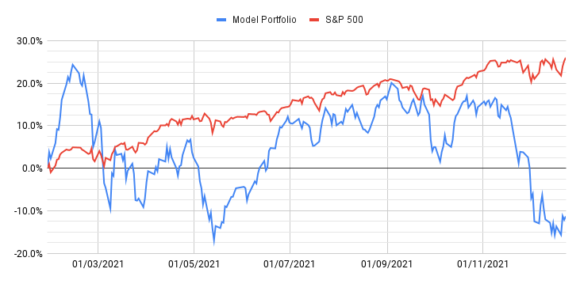

Podcast #71 – Model portfolio year-end review

The time has come for the year-end review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The chart above illustrates the torrid time the last quarter has been for growth stocks and our model portfolio. As growth investors, you get somewhat accustomed to volatility but this year has been especially turbulent as investor sentiment swung back and forth due to a series of world events. This was the year to be an index investor as the S&P steadily climbed and ended the year up almost 30%.

Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

Podcast #66 – Healthtech with Richard Chu

We all want to live longer and healthier lives, so it’s no surprise that healthcare technology is a major area of research and innovation. Medtech and biotech are key investment themes in the Telescope Investing model portfolio, and in our own personal portfolios.

This week we had the pleasure of connecting with healthtech expert investor Richard Chu. Richard shares his thoughts on the healthtech sector, his key investments in this area including GoodRx, Doximity, and OptimizeRx, and also how he saw the writing on the wall for Teladoc Health and exited early, avoiding the share price slump that has hurt our own returns this year!

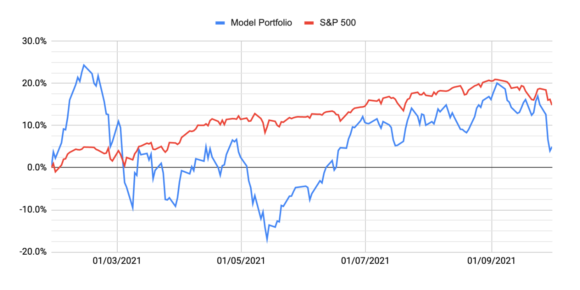

Podcast #59 – Model portfolio Q3 review

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

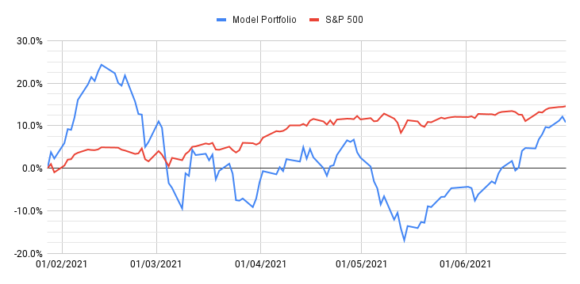

Podcast #46 – Model portfolio Q2 review

It’s time for the half-year review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The sell-off in growth stocks earlier this year made for grim reading at the end of Q1, but many of these stocks have rebounded – ten of the stocks in the model portfolio are now up from our start date, with nine of them beating the market (S&P 500).

Unfortunately, a couple of big losers are dragging down the overall return. While it’s probably too early to declare that “growth is back!”, our portfolio performance at the end of Q2 is much closer to the benchmark of the S&P 500 index. In this episode, we dig into some of the key stories and updates from the portfolio.

Podcast #44 – Live long and prosper

On this week’s pod, we discuss the megatrend of an ageing population and some of the investing opportunities (and risks) this trend creates in society

Podcast #43 – Dear diary

Just over a year ago, when the coronavirus pandemic was beginning, we both started investing journals, to capture our thoughts about life, and the investment opportunities presented by the rapidly changing environment.

In this week’s pod, we revisit some of our journal entries from that period of wild volatility and uncertainty. We saw early signs of the types of businesses that would benefit from stay-at-home orders, and we make some predictions and some investments based on our forecasts of how the business landscape would be impacted. It’s now one year later, so how did we do?

Podcast #35 – Gravity with Zippy Capital

This week, Luke & Albert are joined by Zippy Capital, to discuss Gravity, a South Korean gaming company, and publisher of games based on the Ragnarok franchise, which is extremely popular in South East Asia.