Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #71 – Model portfolio year-end review

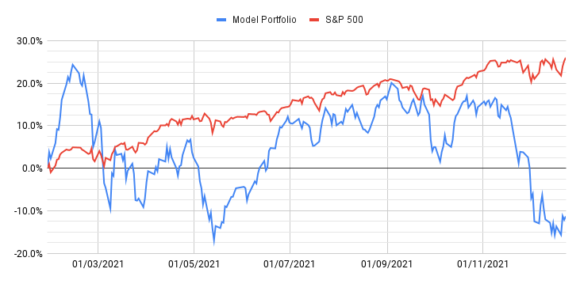

The time has come for the year-end review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The chart above illustrates the torrid time the last quarter has been for growth stocks and our model portfolio. As growth investors, you get somewhat accustomed to volatility but this year has been especially turbulent as investor sentiment swung back and forth due to a series of world events. This was the year to be an index investor as the S&P steadily climbed and ended the year up almost 30%.

Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

Podcast #64 – Marqeta deep dive

In this week’s Pod, we deep dive Marqeta. Their mission is to be the global standard for modern card issuing. They enable other companies to develop, launch and operate card products, by providing the underlying technology that powers many of the new innovations in the payment space, including digital payments, buy-now-pay-later (BNPL), digital wallets, and just-in-time (JIT) funding (automatically funding an account in real-time during the transaction process). Their platform gives their customers full control to build a card that’s right for them and their end-users, allowing them to offer card products in a fraction of the time compared to legacy solutions.

Podcast #59 – Model portfolio Q3 review

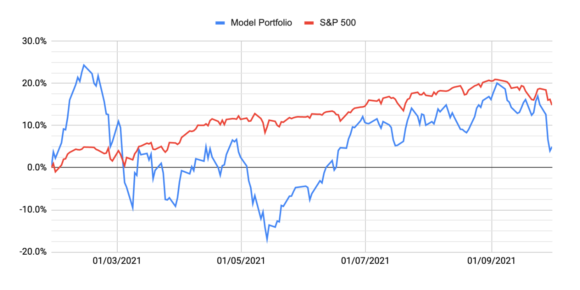

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

Podcast #51 – Digital payments with Jonathan Rowland

The use of digital payments is expanding across the globe, but the transition to a digital financial system is still in its early stages. Fintech companies are receiving heavy investment, as agile companies find new ways to innovate in the payment space.

In this week’s pod, we’re delighted to be joined by Jonathan Rowland, founder and executive chairman of Mode, to give us an inside view on the rise of digital wallets, and the convergence of Open Banking and cryptocurrency in retail.

Podcast #46 – Model portfolio Q2 review

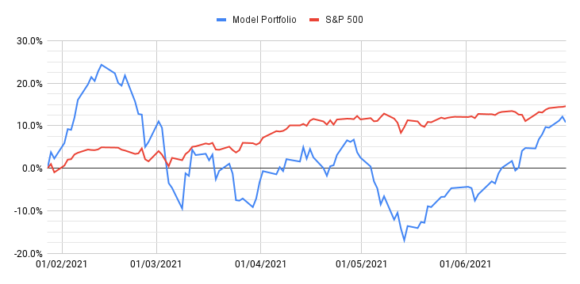

It’s time for the half-year review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The sell-off in growth stocks earlier this year made for grim reading at the end of Q1, but many of these stocks have rebounded – ten of the stocks in the model portfolio are now up from our start date, with nine of them beating the market (S&P 500).

Unfortunately, a couple of big losers are dragging down the overall return. While it’s probably too early to declare that “growth is back!”, our portfolio performance at the end of Q2 is much closer to the benchmark of the S&P 500 index. In this episode, we dig into some of the key stories and updates from the portfolio.

Podcast #43 – Dear diary

Just over a year ago, when the coronavirus pandemic was beginning, we both started investing journals, to capture our thoughts about life, and the investment opportunities presented by the rapidly changing environment.

In this week’s pod, we revisit some of our journal entries from that period of wild volatility and uncertainty. We saw early signs of the types of businesses that would benefit from stay-at-home orders, and we make some predictions and some investments based on our forecasts of how the business landscape would be impacted. It’s now one year later, so how did we do?

Square one-pager

In episode #40 we deep-dived Square, a 2021 model portfolio pick, and one of the highest conviction stocks in our own real-money portfolios. Here’s our one-pager summary.

Podcast #40 – Square deep dive

Square was founded in 2009, when glass-blower Jim McKelvey found he was unable to complete a sale because he couldn’t accept credit cards. He discussed the problem with his friend Jack Dorsey, and they co-founded Square, initially selling a cost-effective mobile phone accessory that allowed small businesses to accept credit card payments. This has since expanded to over 30 products and services for both sellers and consumers.

Square is one of the Telescope Investing model portfolio stocks, and in this week’s pod Luke & Albert deep dive into the company and discuss recent developments for this fast-growing player in the e-payments space.