Podcast #37 – Managing a portfolio

In this week’s pod, Luke and Albert answer some listener questions on portfolio management and talk about how they approach starting, adding, trimming and sometimes exiting a position

Podcast #33 – Model portfolio Q1 review

In this week’s episode, Luke & Albert check in with their model portfolio and see how the stock picks have performed in the first quarter, but more importantly, how the businesses have fared and whether or not the investment theses have changed.

Our investment plan for 2021

At Telescope Investing, we’re firm advocates of the long term buy and hold approach. We try our best to make sense of the world, and then to make forecasts about the needs and demands of the world a year or ten years from now, and then we try to find the companies that we think are best positioned right now to serve that need.

In this article, Luke describes how these principles were used to create the 2021 model portfolio

Podcast #22 – Model portfolio first half

In this week’s episode, Luke and Albert reveal the first half of their model portfolio for 2021, covering the megatrends of e-commerce, fintech, medtech and entertainment. They also answer a listener question about one of the best problems to have as an investor – what to do when one of your stocks grows to become an oversized position within your portfolio

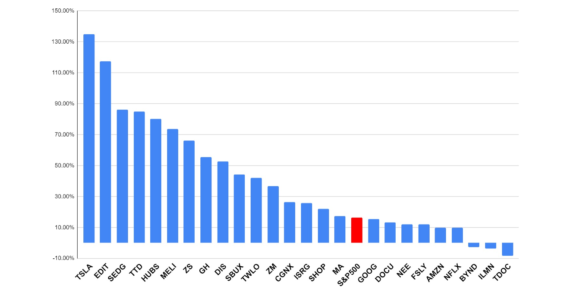

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January

Is the pandemic fever breaking?

As 2020 draws to a close and I consider what next year may hold, it thankfully seems likely that we’ll put the Coronaconomy behind us. A number of strong vaccine candidates are starting to roll-out, and although it’ll take at least a quarter or two, I’m optimistic that by mid-year normal service will largely be restored. In this article, I consider what this could means for my investment portfolio, and why it might be time to trim a few of my ‘work from home’ stocks

Is Zoom doomed and are they shutting up shop at Shopify?”

The Coronavirus pandemic has accelerated the take-up of e-commerce and remote working across a broad range of society, as many people have been forced to shop, and to work, online. Luke looks ahead to what a post-Covid world could look like for his Coronaconomy investments

Podcast #11 – Alternatives to Amazon

After Amazon announced another record quarter last week, it’s easy to lose track of the other companies helping the world to shop online. In this week’s episode, Luke and Albert take a look at four other e-commerce companies experiencing the tailwinds of online shopping during the coronavirus pandemic, and consider what the future holds for them

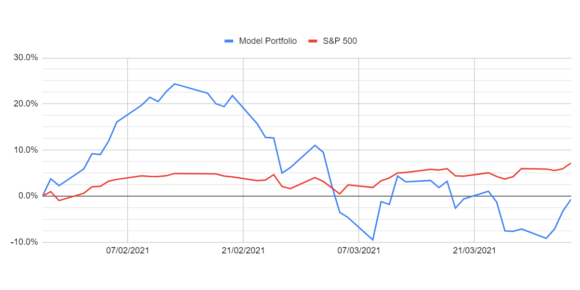

Model portfolio first quarter review – beating the market by 17%

Luke undertakes a first quarter review of the Telescope model portfolio, created in July, and provides a few thoughts on how he might do things differently today

Build a million-dollar investment portfolio by 30

The guys provide a practical roadmap to building a million-dollar investment portfolio for your children.