Podcast #59 – Model portfolio Q3 review

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

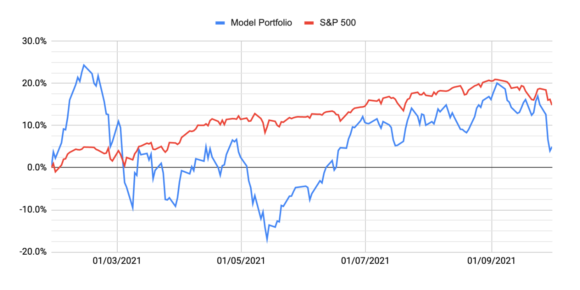

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

More stock therapy

On this week’s Pod Albert and I had a bit of a therapy session, sharing the woes of all growth investors, reflecting on some of the actions we’ve taken over the last few months to prepare ourselves for this eventuality, and also steeling ourselves for the volatility that is doubtless going to persist for many months (years?) yet.

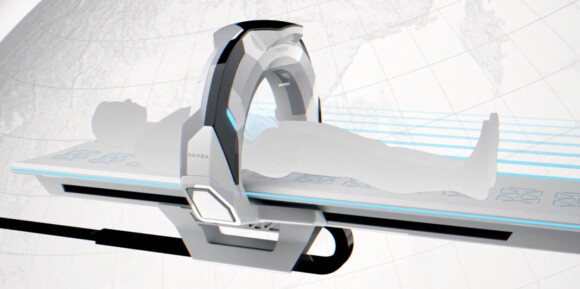

Nano-X Imaging one-pager

This one-pager summarises the key points as we looked at Nano-X Imaging through our ‘investing lenses’. Nano-X promise to make medical imaging more accessible and more affordable for everyone. They have developed a new type of X-ray technology that is smaller, lighter and less expensive to manufacture and operate, and an innovative pay-per-scan business model. But there are significant red flags, and if FDA approval as a Class II medical device is not granted, it’s very likely that this company goes to zero

Podcast #32 – Our wildest stock pick so far! Nano-X Imaging

This week Luke & Albert take a deep-dive into another potential hypergrowth stock-pick. Nano-X Imaging promises to make medical imaging more accessible and more affordable for everyone. They have developed a new type of X-ray technology that is smaller, lighter and less expensive to manufacture and operate, and an innovative pay-per-scan business model. However, with no earnings, no sales and as yet, no regulatory approval, is this revolutionary technology too good to be true?