Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #67 – Disney deep dive

This week on the Pod, we take a deeper look at Disney, a powerhouse in the entertainment industry, known the world over.

The coronavirus pandemic has proven to be a difficult time for the company, with most theme parks and cruise lines shut down or running at reduced capacity, and theatrical releases hobbled by national lockdowns. The silver lining has been the success of their Disney+ streaming service, driven by the increased demand for home entertainment, however recent subscriber growth numbers have been muted.

With no indication of when Covid restrictions will fully lift, the big question is can Disney navigate the storm and continue to grow?

Podcast #62 – Company culture with Renee Conklin

It’s not something that’s usually covered in quarterly earnings reports, but company culture can have a big impact on employees, customers, business performance, and the company’s stock price. This week on the pod, we’re joined by Renee Conklin, founder of RC HR Consulting, to talk about company culture – how to assess it, its impacts on business results, and what companies can do to attract and retain talent. Also, we chat about famous CEOs, the Great Resignation and driving tractors!

Podcast #56 – Into the mailbag

In this week’s pod, we dip into the mailbag to answer some listener questions on high valuation companies and diversification across asset classes. We also goggle at the madness of NFTs and talk about when it’s the right vs wrong time to sell. Transcript Albert: Hi, this is Albert. Luke:

Podcast #43 – Dear diary

Just over a year ago, when the coronavirus pandemic was beginning, we both started investing journals, to capture our thoughts about life, and the investment opportunities presented by the rapidly changing environment.

In this week’s pod, we revisit some of our journal entries from that period of wild volatility and uncertainty. We saw early signs of the types of businesses that would benefit from stay-at-home orders, and we make some predictions and some investments based on our forecasts of how the business landscape would be impacted. It’s now one year later, so how did we do?

Podcast #29 – Our first hypergrowth stock, CuriosityStream

This week, Luke & Albert begin their search for hypergrowth stocks, smallcap and microcap companies with the potential of delivering 10X returns or higher. They set out some thoughts on the criteria that will be used in this search, and deep-dive a new player in the megatrend of streaming entertainment, CuriosityStream, as a potential hypergrowth stock

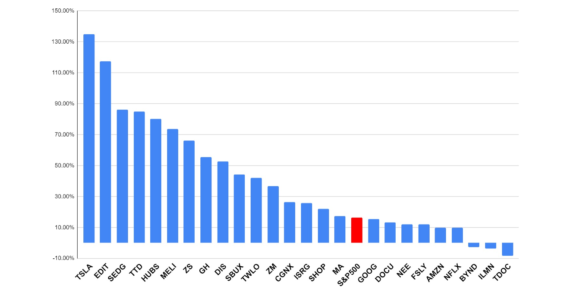

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January

Podcast #14 – 100 baggers

If you’d invested $1,000 in Amazon at its IPO in 1997, your shares would now be worth over $2,000,000. Investing in the right companies can result in life-changing returns, but how do you find those companies? In this week’s episode, Luke & Albert take a look at Christopher Mayer’s book, ‘100 Baggers’, and discuss some of the core principles of finding extreme growth companies

Model portfolio first quarter review – beating the market by 17%

Luke undertakes a first quarter review of the Telescope model portfolio, created in July, and provides a few thoughts on how he might do things differently today