Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

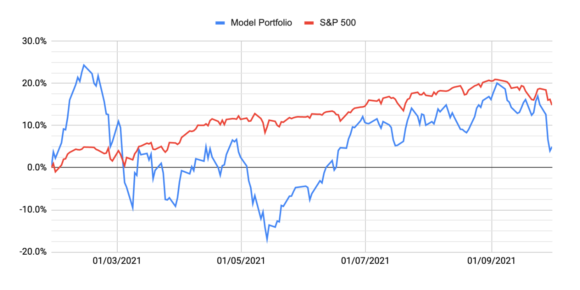

Podcast #59 – Model portfolio Q3 review

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

Matterport one-pager

In episode #55 of the podcast, we did a deep dive into another potential hypergrowth stock, Matterport. Matterport is a leading spatial data company that recently entered the public markets via a SPAC. Here’s a one-pager summarising the key points from our research.

Podcast #55 – Matterport deep dive

Matterport is the world’s leading spatial data company specializing in digitizing physical spaces. They make it easy to create digital models of the real world and to share those spaces anywhere.