Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

More stock therapy

On this week’s Pod Albert and I had a bit of a therapy session, sharing the woes of all growth investors, reflecting on some of the actions we’ve taken over the last few months to prepare ourselves for this eventuality, and also steeling ourselves for the volatility that is doubtless going to persist for many months (years?) yet.

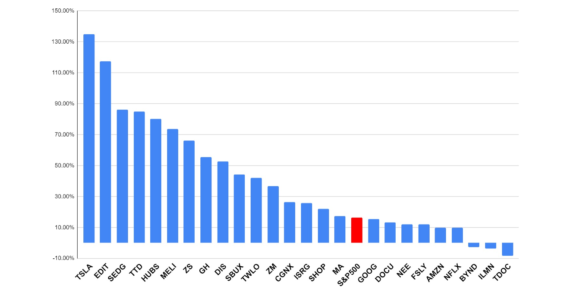

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January

Podcast #13 – Investing in biomedicine

In this week’s episode, Luke & Albert review how recent advances in COVID vaccines could affect markets, and follow up with a discussion on the megatrend of biomedicine. Recent advances in genetics such as CRISPR have the potential to deliver amazing new treatments for many incurable conditions, and the guys discuss some of the companies working on these life-changing therapies and consider whether they’re worth investment

Model portfolio first quarter review – beating the market by 17%

Luke undertakes a first quarter review of the Telescope model portfolio, created in July, and provides a few thoughts on how he might do things differently today

How to size a position

Luke shares his current portfolio, and talks about his personal approach to dollar cost averaging.