Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

CrowdStrike one-pager

In episode #49 of the podcast, we did a deep dive into another one of our model portfolio stocks for 2021, CrowdStrike. We both have positions in our personal portfolios. Here’s a one-pager summarising the key points from our deep dive.

Podcast #44 – Live long and prosper

On this week’s pod, we discuss the megatrend of an ageing population and some of the investing opportunities (and risks) this trend creates in society

Podcast #43 – Dear diary

Just over a year ago, when the coronavirus pandemic was beginning, we both started investing journals, to capture our thoughts about life, and the investment opportunities presented by the rapidly changing environment.

In this week’s pod, we revisit some of our journal entries from that period of wild volatility and uncertainty. We saw early signs of the types of businesses that would benefit from stay-at-home orders, and we make some predictions and some investments based on our forecasts of how the business landscape would be impacted. It’s now one year later, so how did we do?

Podcast #40 – Square deep dive

Square was founded in 2009, when glass-blower Jim McKelvey found he was unable to complete a sale because he couldn’t accept credit cards. He discussed the problem with his friend Jack Dorsey, and they co-founded Square, initially selling a cost-effective mobile phone accessory that allowed small businesses to accept credit card payments. This has since expanded to over 30 products and services for both sellers and consumers.

Square is one of the Telescope Investing model portfolio stocks, and in this week’s pod Luke & Albert deep dive into the company and discuss recent developments for this fast-growing player in the e-payments space.

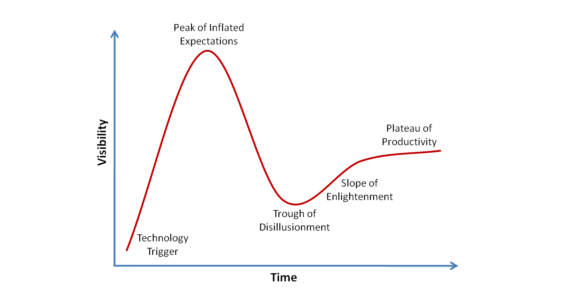

Podcast #34 – Hype cycles

It can be exciting to invest in new innovations and it’s easy to get carried away with the next big thing. In this week’s pod, Luke & Albert take a look at a few recent Gartner hype cycles and talk about some of the innovations that impact their own investments – past, present and future

Podcast #31 – Teladoc Health deep dive

This week, Albert & Luke do a deep-dive into another stock in the model portfolio for 2021, Teladoc Health, a leader in telehealth and digital therapeutics. Teladoc’s mission is to create a virtual healthcare system to improve care and cut the cost of healthcare for all. They have grown revenues rapidly over the last three years, boosted in part by the global pandemic, but do they have what it takes to fend off the increasing competition chasing them from the rear?

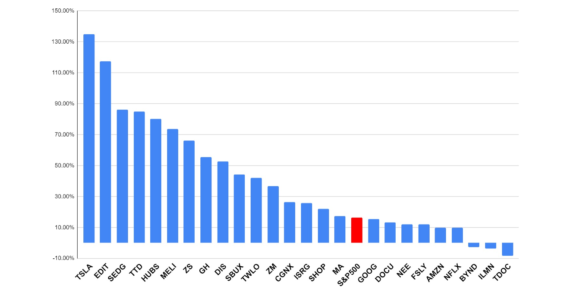

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January