Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Podcast #71 – Model portfolio year-end review

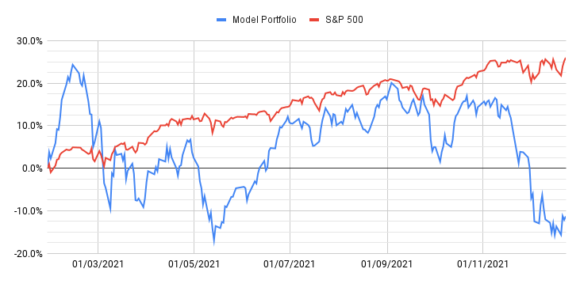

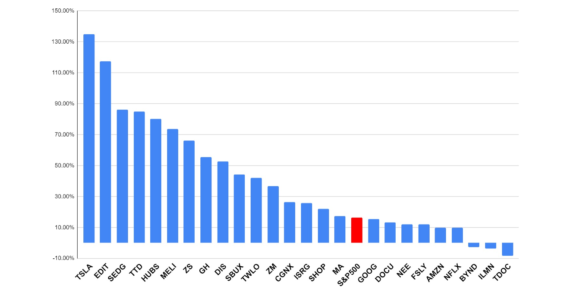

The time has come for the year-end review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The chart above illustrates the torrid time the last quarter has been for growth stocks and our model portfolio. As growth investors, you get somewhat accustomed to volatility but this year has been especially turbulent as investor sentiment swung back and forth due to a series of world events. This was the year to be an index investor as the S&P steadily climbed and ended the year up almost 30%.

Podcast #61 – Investing in disruptive innovation with Simon Erickson

This week we were delighted to connect with Simon Erickson, founder and CEO of 7investing.com, to chat about a topic that underpins both the 7investing and Telescope Investing strategy – investing in disruptive innovation.

Simon shares his thoughts on finding and evaluating disruptive companies, why larger companies find disruptive innovation difficult, playing offence and defence in your portfolio, plus we chat about hype vs fundamentals, craft beer, and being neighbours with Morgan Housel!

If you’re a growth investor, this episode is pure gold – highly recommended listening for all Telescope subscribers.

Podcast #59 – Model portfolio Q3 review

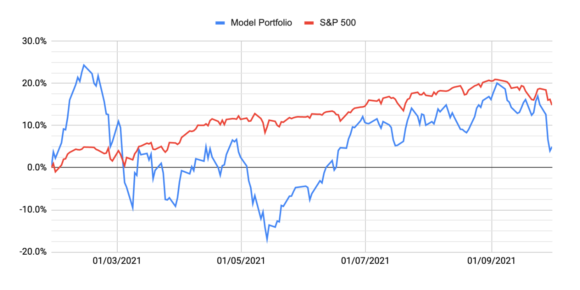

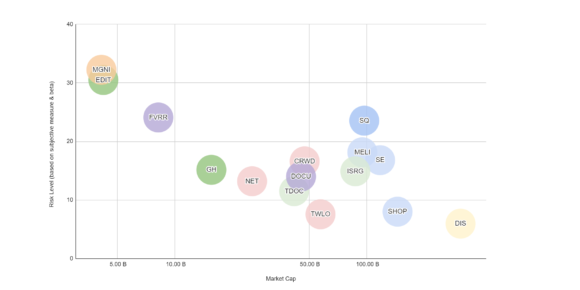

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

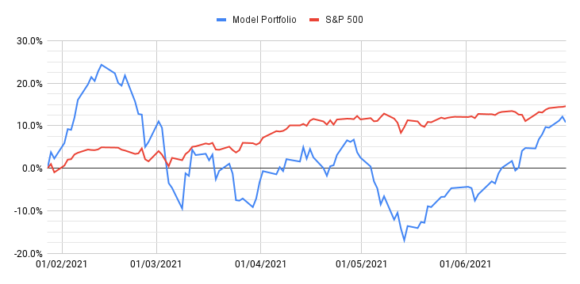

Podcast #46 – Model portfolio Q2 review

It’s time for the half-year review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The sell-off in growth stocks earlier this year made for grim reading at the end of Q1, but many of these stocks have rebounded – ten of the stocks in the model portfolio are now up from our start date, with nine of them beating the market (S&P 500).

Unfortunately, a couple of big losers are dragging down the overall return. While it’s probably too early to declare that “growth is back!”, our portfolio performance at the end of Q2 is much closer to the benchmark of the S&P 500 index. In this episode, we dig into some of the key stories and updates from the portfolio.

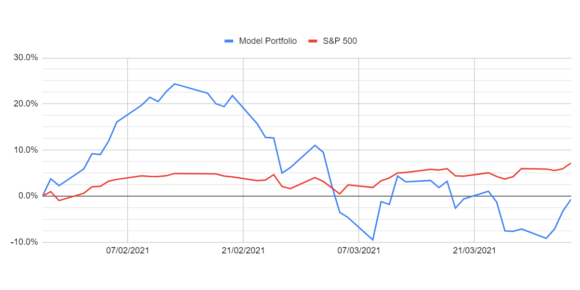

Podcast #33 – Model portfolio Q1 review

In this week’s episode, Luke & Albert check in with their model portfolio and see how the stock picks have performed in the first quarter, but more importantly, how the businesses have fared and whether or not the investment theses have changed.

Our investment plan for 2021

At Telescope Investing, we’re firm advocates of the long term buy and hold approach. We try our best to make sense of the world, and then to make forecasts about the needs and demands of the world a year or ten years from now, and then we try to find the companies that we think are best positioned right now to serve that need.

In this article, Luke describes how these principles were used to create the 2021 model portfolio

Podcast #23 – Model portfolio 2021

This week, Luke and Albert complete their model portfolio for 2021 with the final eight stocks, announcing their picks for the megatrends of biotech, digital transformation, flexible workforce and multichannel marketing. The model portfolio contains the stocks that they will be invested in over the coming year, so it’s time to put the chips on the line!

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January

Podcast #13 – Investing in biomedicine

In this week’s episode, Luke & Albert review how recent advances in COVID vaccines could affect markets, and follow up with a discussion on the megatrend of biomedicine. Recent advances in genetics such as CRISPR have the potential to deliver amazing new treatments for many incurable conditions, and the guys discuss some of the companies working on these life-changing therapies and consider whether they’re worth investment