Our investment plan for 2021

At Telescope Investing, we’re firm advocates of the long term buy and hold approach. We try our best to make sense of the world, and then to make forecasts about the needs and demands of the world a year or ten years from now, and then we try to find the companies that we think are best positioned right now to serve that need.

In this article, Luke describes how these principles were used to create the 2021 model portfolio

Podcast #23 – Model portfolio 2021

This week, Luke and Albert complete their model portfolio for 2021 with the final eight stocks, announcing their picks for the megatrends of biotech, digital transformation, flexible workforce and multichannel marketing. The model portfolio contains the stocks that they will be invested in over the coming year, so it’s time to put the chips on the line!

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January

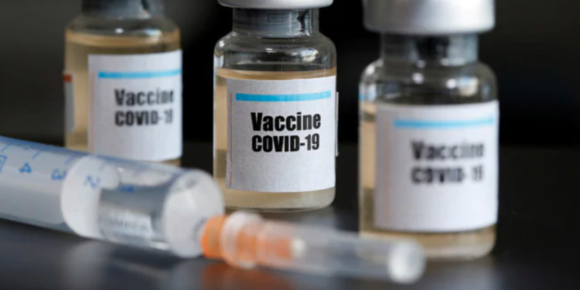

Is the pandemic fever breaking?

As 2020 draws to a close and I consider what next year may hold, it thankfully seems likely that we’ll put the Coronaconomy behind us. A number of strong vaccine candidates are starting to roll-out, and although it’ll take at least a quarter or two, I’m optimistic that by mid-year normal service will largely be restored. In this article, I consider what this could means for my investment portfolio, and why it might be time to trim a few of my ‘work from home’ stocks

Is Zoom doomed and are they shutting up shop at Shopify?”

The Coronavirus pandemic has accelerated the take-up of e-commerce and remote working across a broad range of society, as many people have been forced to shop, and to work, online. Luke looks ahead to what a post-Covid world could look like for his Coronaconomy investments

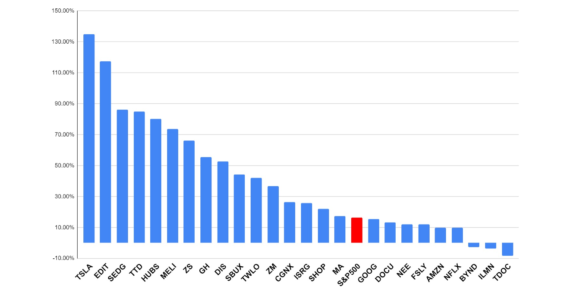

Model portfolio first quarter review – beating the market by 17%

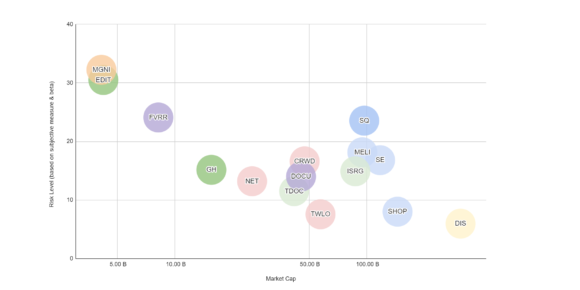

Luke undertakes a first quarter review of the Telescope model portfolio, created in July, and provides a few thoughts on how he might do things differently today

Podcast #8 – Investing in the trend of mobile working

Working from home has been one of the hallmarks of the Coronacomony, but the nature of work was already changing. In this week’s episode, Luke & Albert talk about the drivers and the impacts of an increasingly mobile workforce and share their stock tips for this megatrend.

Zoom earnings

Luke takes a high level look at Zoom’s Q2 quarterly earnings.

What’s on my watchlist currently?

Luke shares details of a couple of the companies he watching right now, and discusses some of the sources he uses for investment ideas.

How to size a position

Luke shares his current portfolio, and talks about his personal approach to dollar cost averaging.