Podcast #70 – Year-end fun

Happy holiday wishes to all of our listeners and subscribers! This week, we’re kicking back from the serious stock analysis and just having a bit of Christmas fun as we look back at some of the highs and lows of 2021. We reflect on our favourite moments on the pod, some of the smartest (and daftest!) things we’ve said, and chat about our favourite episodes and guest interviews. We also hazard making a couple of wild predictions for 2022!

It’s been a great year for Telescope Investing, in no small part due to the listener support and questions we’ve had along the way. Thanks so much for being part of the journey!!

Podcast #59 – Model portfolio Q3 review

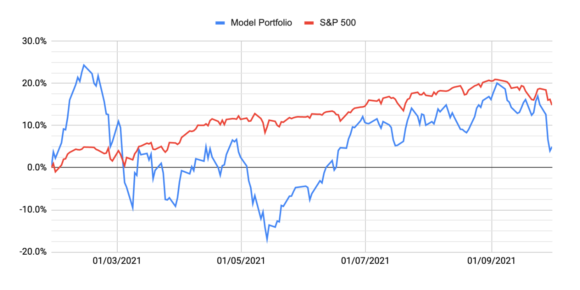

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

More stock therapy

On this week’s Pod Albert and I had a bit of a therapy session, sharing the woes of all growth investors, reflecting on some of the actions we’ve taken over the last few months to prepare ourselves for this eventuality, and also steeling ourselves for the volatility that is doubtless going to persist for many months (years?) yet.

Hypergrowth

Investing in hypergrowth stocks is a high-risk high-return strategy, but we believe it could make sense as part of a balanced portfolio. This week, we’re delighted to announce the start of the Telescope Investing hypergrowth portfolio. In this article we share our criteria for identifying extreme growth investment opportunities

CuriosityStream one-pager

In episode 29 of the Telescope Investing Podcast, Luke and I started our search for hypergrowth companies with a deep-dive into a new player in video streaming, CuriosityStream. This one-pager summarises the research that we did, highlighting the key positive and negative points when considering CuriosityStream as a potential investment.

Podcast #29 – Our first hypergrowth stock, CuriosityStream

This week, Luke & Albert begin their search for hypergrowth stocks, smallcap and microcap companies with the potential of delivering 10X returns or higher. They set out some thoughts on the criteria that will be used in this search, and deep-dive a new player in the megatrend of streaming entertainment, CuriosityStream, as a potential hypergrowth stock