Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

Podcast #67 – Disney deep dive

This week on the Pod, we take a deeper look at Disney, a powerhouse in the entertainment industry, known the world over.

The coronavirus pandemic has proven to be a difficult time for the company, with most theme parks and cruise lines shut down or running at reduced capacity, and theatrical releases hobbled by national lockdowns. The silver lining has been the success of their Disney+ streaming service, driven by the increased demand for home entertainment, however recent subscriber growth numbers have been muted.

With no indication of when Covid restrictions will fully lift, the big question is can Disney navigate the storm and continue to grow?

CrowdStrike one-pager

In episode #49 of the podcast, we did a deep dive into another one of our model portfolio stocks for 2021, CrowdStrike. We both have positions in our personal portfolios. Here’s a one-pager summarising the key points from our deep dive.

Podcast #49 – CrowdStrike deep dive

This week, we deep dive another stock in our 2021 model portfolio, CrowdStrike. It seems that hacking is constantly in the news with disturbing reports of spyware infiltrating our devices and ransomware attacks against government agencies, corporations, and public services. CrowdStrike aims to protect these systems from hackers with an advanced cybersecurity platform powered by artificial intelligence and modern security foundations.

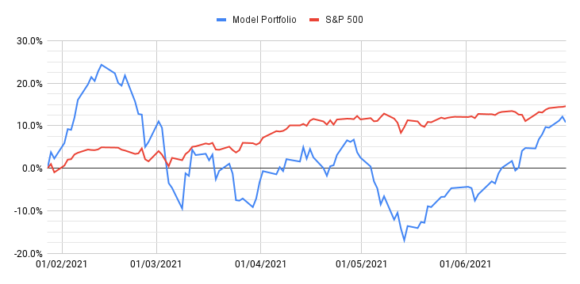

Podcast #46 – Model portfolio Q2 review

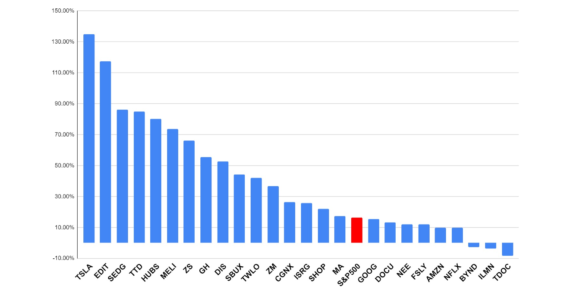

It’s time for the half-year review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The sell-off in growth stocks earlier this year made for grim reading at the end of Q1, but many of these stocks have rebounded – ten of the stocks in the model portfolio are now up from our start date, with nine of them beating the market (S&P 500).

Unfortunately, a couple of big losers are dragging down the overall return. While it’s probably too early to declare that “growth is back!”, our portfolio performance at the end of Q2 is much closer to the benchmark of the S&P 500 index. In this episode, we dig into some of the key stories and updates from the portfolio.

Podcast #31 – Teladoc Health deep dive

This week, Albert & Luke do a deep-dive into another stock in the model portfolio for 2021, Teladoc Health, a leader in telehealth and digital therapeutics. Teladoc’s mission is to create a virtual healthcare system to improve care and cut the cost of healthcare for all. They have grown revenues rapidly over the last three years, boosted in part by the global pandemic, but do they have what it takes to fend off the increasing competition chasing them from the rear?

Podcast #29 – Our first hypergrowth stock, CuriosityStream

This week, Luke & Albert begin their search for hypergrowth stocks, smallcap and microcap companies with the potential of delivering 10X returns or higher. They set out some thoughts on the criteria that will be used in this search, and deep-dive a new player in the megatrend of streaming entertainment, CuriosityStream, as a potential hypergrowth stock

Podcast #20 – 2020 model portfolio review

In the first episode of the new year, Albert and Luke review the Telescope Investing 2020 model portfolio in-depth, and try to understand how it’s outperformed the market by such a substantial margin. They walk through the stocks included, explain why they were chosen, but more importantly discuss the principles that guided the design the portfolio, to inform planning for the new 2021 model portfolio that’s due to launch in January