Podcast #61 – Investing in disruptive innovation with Simon Erickson

This week we were delighted to connect with Simon Erickson, founder and CEO of 7investing.com, to chat about a topic that underpins both the 7investing and Telescope Investing strategy – investing in disruptive innovation.

Simon shares his thoughts on finding and evaluating disruptive companies, why larger companies find disruptive innovation difficult, playing offence and defence in your portfolio, plus we chat about hype vs fundamentals, craft beer, and being neighbours with Morgan Housel!

If you’re a growth investor, this episode is pure gold – highly recommended listening for all Telescope subscribers.

Podcast #60 – Venture capital with Prantik Mazumdar

At Telescope Investing we focus on publicly-listed stocks, but investing in private companies is another option for investors seeking higher returns, and this is becoming increasingly accessible to retail investors through crowdfunding services. On this week’s pod, we’re joined by award-winning entrepreneur and founder Prantik Mazumdar, to get his insights on private equity and venture capital investing.

Prantik brings his extensive experience working with local enterprises in Singapore and as a business owner to the world of angel investing and venture capital. In a wide-ranging discussion, we talk about the key trends in the SE Asian startup scene, the qualities he looks for in private equity investments, and the personal and financial rewards of investing in sustainability.

Podcast #59 – Model portfolio Q3 review

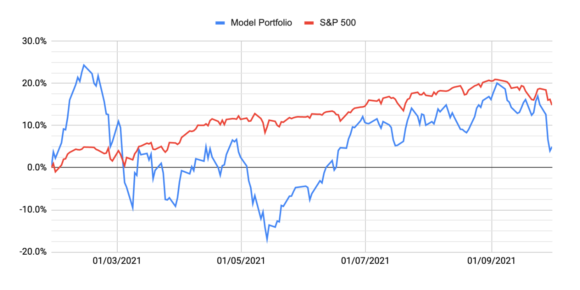

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

Matterport one-pager

In episode #55 of the podcast, we did a deep dive into another potential hypergrowth stock, Matterport. Matterport is a leading spatial data company that recently entered the public markets via a SPAC. Here’s a one-pager summarising the key points from our research.

Podcast #58 – When to sell

The Telescope Investing strategy is to ‘buy & hold’ – we seek to buy good companies and hold them for the long-term – but that doesn’t mean we never sell. This week on the pod we revisit our thoughts on when it might be the right time to sell a stock.

Podcast #57 – Financial wellbeing with Ronald Wong

Personal finance is as much personal as it is financial, and how we feel about money is influenced by the experiences we’ve lived and the stories we tell ourselves. These stories can have both positive and negative impacts on our financial decisions, but we can rewrite those stories and change our attitudes towards wealth. In this week’s pod, we talk to Ronald Wong about the importance of financial wellbeing and how our true net worth is more than our bank balances.

Podcast #56 – Into the mailbag

In this week’s pod, we dip into the mailbag to answer some listener questions on high valuation companies and diversification across asset classes. We also goggle at the madness of NFTs and talk about when it’s the right vs wrong time to sell. Transcript Albert: Hi, this is Albert. Luke:

Podcast #55 – Matterport deep dive

Matterport is the world’s leading spatial data company specializing in digitizing physical spaces. They make it easy to create digital models of the real world and to share those spaces anywhere.

Podcast #54 – Intuitive Surgical with Adu Subramanian

Unless you’ve needed surgery in the past few years, Intuitive Surgical may not be a familiar name, but they’re the global leader in robotic surgery and a pioneer in the field since 1995. Robotic surgery has been steadily improving over the last two decades and is becoming the gold standard

Podcast #53 – Cloud communications with Paul Ruppert

Cloud communications, also known as Communications Platform as a Service (or CPaaS) allows businesses to communicate with their customers using channels such as voice, email, SMS, and instant messaging.

This week we sit down with industry expert, Paul Ruppert, to discuss his insights on this complex market, and hear a few anecdotes from his 20-year career in C-level roles with leading global CPaaS providers including Syniverse, mBlox (Sinch), Infobip, SAP, and Route Mobile.