Podcast #71 – Model portfolio year-end review

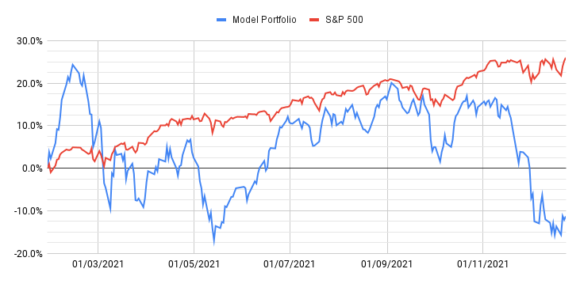

The time has come for the year-end review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The chart above illustrates the torrid time the last quarter has been for growth stocks and our model portfolio. As growth investors, you get somewhat accustomed to volatility but this year has been especially turbulent as investor sentiment swung back and forth due to a series of world events. This was the year to be an index investor as the S&P steadily climbed and ended the year up almost 30%.

Podcast #70 – Year-end fun

Happy holiday wishes to all of our listeners and subscribers! This week, we’re kicking back from the serious stock analysis and just having a bit of Christmas fun as we look back at some of the highs and lows of 2021. We reflect on our favourite moments on the pod, some of the smartest (and daftest!) things we’ve said, and chat about our favourite episodes and guest interviews. We also hazard making a couple of wild predictions for 2022!

It’s been a great year for Telescope Investing, in no small part due to the listener support and questions we’ve had along the way. Thanks so much for being part of the journey!!

Podcast #69 – Airbnb deep dive

This week we’re taking a look at Airbnb, a well-known travel company that’s strongly positioned to benefit from the potential surge in international travel as the pandemic begins to ease and the world reopens.

Podcast #68 – Structuring the 2022 model portfolio

This week we give consideration to the structure of our model portfolio for next year. These are the companies we believe will achieve market-beating returns in 2022 and beyond. In this portfolio structure episode, we consider the megatrends that are likely to shape the world around us for the years ahead and decide what proportion of the portfolio to devote to each of them.

Podcast #67 – Disney deep dive

This week on the Pod, we take a deeper look at Disney, a powerhouse in the entertainment industry, known the world over.

The coronavirus pandemic has proven to be a difficult time for the company, with most theme parks and cruise lines shut down or running at reduced capacity, and theatrical releases hobbled by national lockdowns. The silver lining has been the success of their Disney+ streaming service, driven by the increased demand for home entertainment, however recent subscriber growth numbers have been muted.

With no indication of when Covid restrictions will fully lift, the big question is can Disney navigate the storm and continue to grow?

Podcast #66 – Healthtech with Richard Chu

We all want to live longer and healthier lives, so it’s no surprise that healthcare technology is a major area of research and innovation. Medtech and biotech are key investment themes in the Telescope Investing model portfolio, and in our own personal portfolios.

This week we had the pleasure of connecting with healthtech expert investor Richard Chu. Richard shares his thoughts on the healthtech sector, his key investments in this area including GoodRx, Doximity, and OptimizeRx, and also how he saw the writing on the wall for Teladoc Health and exited early, avoiding the share price slump that has hurt our own returns this year!

Podcast #65 – Listener questions

In the pod this week, we field some of the fantastic questions we’ve received recently from our listeners. We give our take on panic selling, investing during high inflation, using leverage, choosing between investment options and having diversification within your investment portfolio. And one of us takes the next step in their investing journey!

Podcast #64 – Marqeta deep dive

In this week’s Pod, we deep dive Marqeta. Their mission is to be the global standard for modern card issuing. They enable other companies to develop, launch and operate card products, by providing the underlying technology that powers many of the new innovations in the payment space, including digital payments, buy-now-pay-later (BNPL), digital wallets, and just-in-time (JIT) funding (automatically funding an account in real-time during the transaction process). Their platform gives their customers full control to build a card that’s right for them and their end-users, allowing them to offer card products in a fraction of the time compared to legacy solutions.

Podcast #62 – Company culture with Renee Conklin

It’s not something that’s usually covered in quarterly earnings reports, but company culture can have a big impact on employees, customers, business performance, and the company’s stock price. This week on the pod, we’re joined by Renee Conklin, founder of RC HR Consulting, to talk about company culture – how to assess it, its impacts on business results, and what companies can do to attract and retain talent. Also, we chat about famous CEOs, the Great Resignation and driving tractors!