E2: Dumpster Diving

Episode 2 of Wall Street Wildlife finds Badger in Hong Kong, a perfect location from which to teach Monkey about the nuances of portfolio risk management, and the dangers of feasting on too many rotten stock bananas, like, say, $EOSE Eos Energy, Monkey’s fatal obsession. In Phoenix or Dodo, we

E2 (bonus episode): A Fragile Market

Wall Street Wildlife’s first bonus episode introduces a Vulture circling above the tree canopy! That’s because the market jungle is not just bulls and bears and monkeys and badgers – there are also birds of prey who take advantage of any meat left on the bone, no matter the source.

E1: Welcome to the Jungle

Join Luke “the badger” Hallard and Krzysztof “the monkey” Piekarski as they dig through the jungle of Wall Street on their podcast, “Wall Street Wildlife.” Whether you’re a fresh-faced fawn in the stock market or a grizzled old bear with seasoned portfolios, this podcast has the nuts and berries to

Welcome to Wall Street Wildlife

Wall Street Wildlife: where the worlds of technology, business, stock markets, and animal spirits collide. 7investing lead analysts Luke ‘The Badger’ Hallard and Krzysztof ‘Monkey’ Piekarski bring you a curated digest of investing insights and principles to help you better understand how to make money in the stock market. Perfect

How to construct your portfolio

Albert gives some examples of how a new portfolio can be put together, and shares a view on the benefits of diversification.

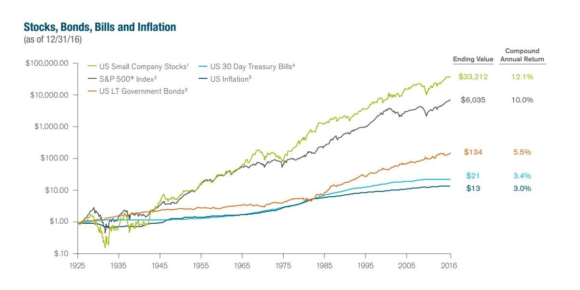

Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Should I start investing?

Investing isn’t right for everybody, this post discusses some of the reasons why you may not want to start your investing journey today.

How I manage my own portfolio

Luke discusses how he uses the Telescope Investing approach to manage his own portfolio, and how this informed his recent purchase of Fastly, and a reduction in his Tesla position.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Podcast #72 – A big announcement

At the start of December, we began the research for the Telescope Investing 2022 model portfolio. Our apologies to long-term listeners of the show, but we’re afraid to say that this will not be launching. As we enter 2022, we have something important to announce.