How to construct your portfolio

Albert gives some examples of how a new portfolio can be put together, and shares a view on the benefits of diversification.

Smallcap growth

Luke and Albert share a large-cap and small-cap model portfolio. If we were starting out from scratch today, this is where we’d start.

Should I start investing?

Investing isn’t right for everybody, this post discusses some of the reasons why you may not want to start your investing journey today.

How I manage my own portfolio

Luke discusses how he uses the Telescope Investing approach to manage his own portfolio, and how this informed his recent purchase of Fastly, and a reduction in his Tesla position.

Advice for a new investor

Luke and Albert discuss some of the considerations for a new investor, and provide a couple of starting points for research.

Investing musically

Luke reflects on how learning to play the piano has many similarities with becoming a better investor

More stock therapy

On this week’s Pod Albert and I had a bit of a therapy session, sharing the woes of all growth investors, reflecting on some of the actions we’ve taken over the last few months to prepare ourselves for this eventuality, and also steeling ourselves for the volatility that is doubtless going to persist for many months (years?) yet.

Hypergrowth

Investing in hypergrowth stocks is a high-risk high-return strategy, but we believe it could make sense as part of a balanced portfolio. This week, we’re delighted to announce the start of the Telescope Investing hypergrowth portfolio. In this article we share our criteria for identifying extreme growth investment opportunities

Our investment plan for 2021

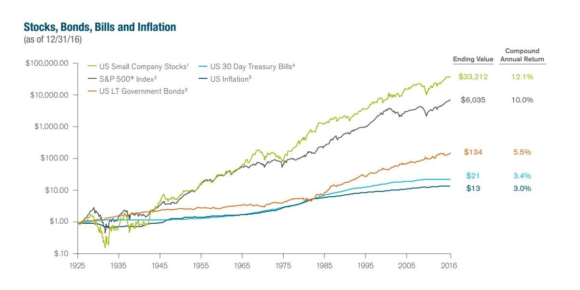

At Telescope Investing, we’re firm advocates of the long term buy and hold approach. We try our best to make sense of the world, and then to make forecasts about the needs and demands of the world a year or ten years from now, and then we try to find the companies that we think are best positioned right now to serve that need.

In this article, Luke describes how these principles were used to create the 2021 model portfolio

Is the pandemic fever breaking?

As 2020 draws to a close and I consider what next year may hold, it thankfully seems likely that we’ll put the Coronaconomy behind us. A number of strong vaccine candidates are starting to roll-out, and although it’ll take at least a quarter or two, I’m optimistic that by mid-year normal service will largely be restored. In this article, I consider what this could means for my investment portfolio, and why it might be time to trim a few of my ‘work from home’ stocks