Podcast #60 – Venture capital with Prantik Mazumdar

At Telescope Investing we focus on publicly-listed stocks, but investing in private companies is another option for investors seeking higher returns, and this is becoming increasingly accessible to retail investors through crowdfunding services. On this week’s pod, we’re joined by award-winning entrepreneur and founder Prantik Mazumdar, to get his insights on private equity and venture capital investing.

Prantik brings his extensive experience working with local enterprises in Singapore and as a business owner to the world of angel investing and venture capital. In a wide-ranging discussion, we talk about the key trends in the SE Asian startup scene, the qualities he looks for in private equity investments, and the personal and financial rewards of investing in sustainability.

Podcast #59 – Model portfolio Q3 review

It’s time for the Q3 review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021.

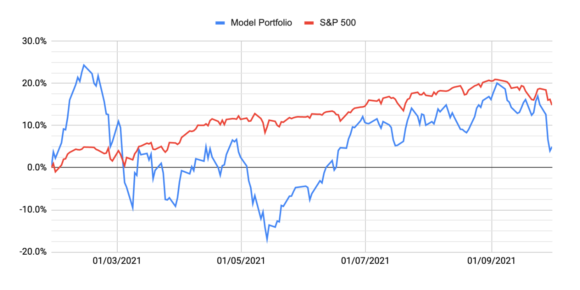

Following a nice recovery in Q2, the model portfolio was steadily making gains during the third quarter, but on the 22nd Sep the market started trending downwards and growth stocks were hit harder than the general market, and the model portfolio lost 15.1% in value by the end of the quarter while the S&P lost only 6.1%.

Only eight out of the 15 stocks are showing positive returns from the inception of the portfolio in Jan, with just six of those beating the S&P. However in most cases, this underperformance is not a result of the company failing to execute, and was driven by macro-economic factors impacting the value of future cash flows, which growth stocks are far more dependent on than more mature companies.

In today’s episode, we dig into some of the key stories and updates for each stock in the portfolio.

Podcast #57 – Financial wellbeing with Ronald Wong

Personal finance is as much personal as it is financial, and how we feel about money is influenced by the experiences we’ve lived and the stories we tell ourselves. These stories can have both positive and negative impacts on our financial decisions, but we can rewrite those stories and change our attitudes towards wealth. In this week’s pod, we talk to Ronald Wong about the importance of financial wellbeing and how our true net worth is more than our bank balances.

Podcast #56 – Into the mailbag

In this week’s pod, we dip into the mailbag to answer some listener questions on high valuation companies and diversification across asset classes. We also goggle at the madness of NFTs and talk about when it’s the right vs wrong time to sell. Transcript Albert: Hi, this is Albert. Luke:

Podcast #54 – Intuitive Surgical with Adu Subramanian

Unless you’ve needed surgery in the past few years, Intuitive Surgical may not be a familiar name, but they’re the global leader in robotic surgery and a pioneer in the field since 1995. Robotic surgery has been steadily improving over the last two decades and is becoming the gold standard

Podcast #53 – Cloud communications with Paul Ruppert

Cloud communications, also known as Communications Platform as a Service (or CPaaS) allows businesses to communicate with their customers using channels such as voice, email, SMS, and instant messaging.

This week we sit down with industry expert, Paul Ruppert, to discuss his insights on this complex market, and hear a few anecdotes from his 20-year career in C-level roles with leading global CPaaS providers including Syniverse, mBlox (Sinch), Infobip, SAP, and Route Mobile.

Podcast #52 – One-year anniversary party!

We started the Telescope Investing podcast exactly one year ago with no expectations, and along the way, we’ve connected with some awesome people and learnt a lot.

This week, we’re joined by a few friends who have been with us on our podcasting journey, to celebrate our first year of the pod. Don’t expect much on investing wisdom, just fun and laughs as we kick back and talk about ourselves and our reflections on a year of doing the pod. And competitive as always, we face-off in a quiz at the end to see which of us really knows more about stocks! A free dinner is on the line so the steaks are not high, more medium.

Podcast #51 – Digital payments with Jonathan Rowland

The use of digital payments is expanding across the globe, but the transition to a digital financial system is still in its early stages. Fintech companies are receiving heavy investment, as agile companies find new ways to innovate in the payment space.

In this week’s pod, we’re delighted to be joined by Jonathan Rowland, founder and executive chairman of Mode, to give us an inside view on the rise of digital wallets, and the convergence of Open Banking and cryptocurrency in retail.

CrowdStrike one-pager

In episode #49 of the podcast, we did a deep dive into another one of our model portfolio stocks for 2021, CrowdStrike. We both have positions in our personal portfolios. Here’s a one-pager summarising the key points from our deep dive.

Podcast #48 – Bad advice!

Bad advice is all around us, financial or otherwise, and it is sometimes difficult to separate the good advice from the bad. We asked our listeners about the bad financial advice they’ve heard or seen, and in the pod this week, we discuss some of the doozies we received. Some anecdotes are relatively trivial, but some are more serious with potentially ruinous consequences. We look at them from both sides and see if there is anything we can learn from them. We also have a couple of gambling stories because that’s just fun!