How to construct your portfolio

Albert gives some examples of how a new portfolio can be put together, and shares a view on the benefits of diversification.

Podcast #72 – A big announcement

At the start of December, we began the research for the Telescope Investing 2022 model portfolio. Our apologies to long-term listeners of the show, but we’re afraid to say that this will not be launching. As we enter 2022, we have something important to announce.

Podcast #71 – Model portfolio year-end review

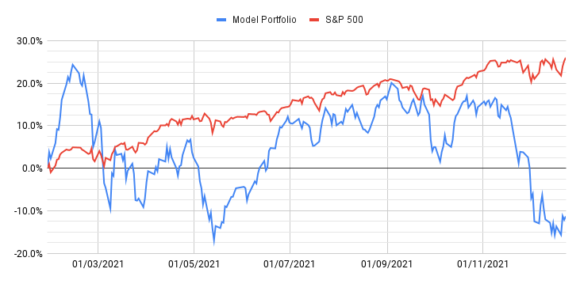

The time has come for the year-end review of our model portfolio, a collection of 15 stocks that we selected in January as our core investments for 2021. The chart above illustrates the torrid time the last quarter has been for growth stocks and our model portfolio. As growth investors, you get somewhat accustomed to volatility but this year has been especially turbulent as investor sentiment swung back and forth due to a series of world events. This was the year to be an index investor as the S&P steadily climbed and ended the year up almost 30%.

Podcast #65 – Listener questions

In the pod this week, we field some of the fantastic questions we’ve received recently from our listeners. We give our take on panic selling, investing during high inflation, using leverage, choosing between investment options and having diversification within your investment portfolio. And one of us takes the next step in their investing journey!

Podcast #62 – Company culture with Renee Conklin

It’s not something that’s usually covered in quarterly earnings reports, but company culture can have a big impact on employees, customers, business performance, and the company’s stock price. This week on the pod, we’re joined by Renee Conklin, founder of RC HR Consulting, to talk about company culture – how to assess it, its impacts on business results, and what companies can do to attract and retain talent. Also, we chat about famous CEOs, the Great Resignation and driving tractors!

Matterport one-pager

In episode #55 of the podcast, we did a deep dive into another potential hypergrowth stock, Matterport. Matterport is a leading spatial data company that recently entered the public markets via a SPAC. Here’s a one-pager summarising the key points from our research.

Podcast #58 – When to sell

The Telescope Investing strategy is to ‘buy & hold’ – we seek to buy good companies and hold them for the long-term – but that doesn’t mean we never sell. This week on the pod we revisit our thoughts on when it might be the right time to sell a stock.

Podcast #55 – Matterport deep dive

Matterport is the world’s leading spatial data company specializing in digitizing physical spaces. They make it easy to create digital models of the real world and to share those spaces anywhere.

Podcast #50 – Financial education for your children

Back in episode #12 of the podcast, we talked about investing for your children. At some point, your children will leave the nest and take control of their own finances, and we believe that financial education early in life is a big advantage in navigating the world of money and investing! This week on the podcast, we’re joined by our good friend, Duniya, to talk about how parents can prepare their children to manage their finances responsibly and successfully.

Podcast #49 – CrowdStrike deep dive

This week, we deep dive another stock in our 2021 model portfolio, CrowdStrike. It seems that hacking is constantly in the news with disturbing reports of spyware infiltrating our devices and ransomware attacks against government agencies, corporations, and public services. CrowdStrike aims to protect these systems from hackers with an advanced cybersecurity platform powered by artificial intelligence and modern security foundations.